We share the video of a talk by Enikő Vincze, housing justice activist at Căși sociale ACUM!/Social housing NOW! and professor at Babes-Bolyai University in Cluj, Romania, given as part of the seminar series organized by the Torino-based Beyond Inhabitation Lab. The talk presented results of the academic research “Class formation and re-urbanization through real estate development in an Eastern periphery of global capitalism” (REDURB, 2021-2023). However, it ended by formulating some challenging questions that profit-oriented urban development raises for housing activists: If real estate development for profit is a central pillar of global capitalism as it is, how can we imagine and practice struggles against exploitation and dispossession happening via a capital accumulation regime into which this business is so embedded? What kind of alliances should housing movements look for in their endeavors among social movements with other causes or among political initiatives at local and international levels looking to transgress capitalism?

This talk, which analyzes the transformation of industrial platforms into real estate development sites in Romania, underscores the global interest in the country’s real estate sector. The country’s favorable fiscal regime has attracted diverse investors, as evidenced by the CBRE (real estate services company) data. In the first half of 2021, the total volume of real estate investments in Romania reached 303.6 million euros, with the most significant contributions coming from Austrians, Americans, and Czechs. Buyers from South Africa, Sweden, Switzerland, Germany, and Greece also participated, while Romanians contributed only 1% to the volume of real estate investments. The theoretical/conceptual frame of the REDURB analysis was built on the conviction that we need to consider both global and local processes and actors and the role of both economy and politics in explaining why real estate development as a business emerged and advanced in Romania as it did.

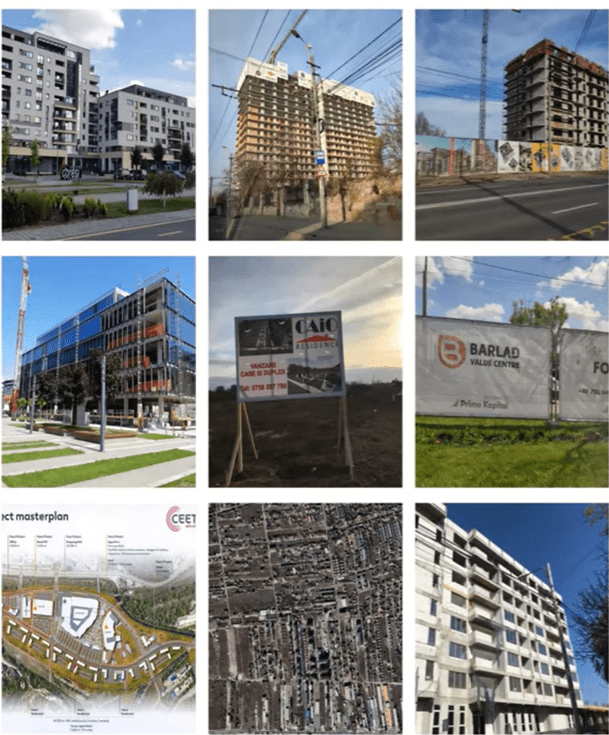

The talk focuses on the case study in Brașov, situated in the country’s Central Development Region. It illustrates how private investment strategies and state interventions transformed a socialist industrial platform (the Tractorul Factory) into a site for capitalist real estate development (a mixed-use Coresi district including shopping, residential, office, and hotel areas). The investment of 350 million euros was made by Ceetrus, the financialized mixed-use investor-developer company owned by the French multinational Auchan Holding, that entered into partnerships with local companies, such as Kasper Development, Ascenta Management, and Kronwell.

Beyond this particular case, the talk pinpoints the role post-socialist deindustrialization has played, alongside other factors, in the advancement of real estate development in Romania. Deindustrialization-cum-privatization facilitated the primitive accumulation of capital as it transposed the ownership over the means of production to the hands of the emerging property-owner class. The private property funds created by the state in 1992, responsible for the privatization of factories, owned shares in these enterprises that they could capitalize on later when they were transformed into private equity funds, some with real estate investments. The winners of deindustrialization could direct their capital towards real estate development and investments into funds with shares in real estate. Deindustrialization contributed to the creation of debtors/ entrepreneurs involved in privatization and real estate development, which impacted the flourishing of the banking sector.

Deindustrialization enabled the owners of privatized and bankrupted factories to extract long-term income from renting the lands and buildings usually purchased at a low price from the state to different enterprises, from small productive units to artists, to warehouses, to sports halls. Deindustrialization emptied spaces which, when the capital was ready, could be invested in for new residential, retail, or office buildings or mixed-use complexes, providing the opportunity for owners to combine profit from selling with profit from renting. Lands emptied from industrial production could be used as the collateral and catalyst for loans based on land value.

Deindustrialization facilitated the collaboration between local and global capital. It also contributed to the contraction of the productive economy, benefitting consumption-based and financialized growth. In Romania, deindustrialization happened in the context of capitalist state and economic restructuring when global capitalism, characterized by uneven geographical development, was already marked by increased financialization. In parallel with the dismantlement of state socialism, the renewed semiperipheral condition of the country favored its use by foreign capital as a source of a cheap labor force, new capital investment opportunities, and markets. Advancing at the turn of the millennium, real estate development in this country was shaped by both deindustrialization and financialization. Investigations of financialization usually show how financialization de-territorializes real estate development by integrating its products into global financial flows. The REDURB analysis re-territorialized investigations of financialization by showing that it is both a spatial and financial process by connecting it to deindustrialization.A collective volume based on the REDURB research project, Uneven Real Estate Development in Romania at the Intersection of Deindustrialization and Financialization, edited by Enikő Vincze, Ioana Florea, and Manuel Aalbers, is forthcoming at Routledge.