Note from LeftEast Editors: The original interview was conducted by Istanbul-based Imre Azem and Gaye Günay as part of a documentary movie project on global finance. It was first published in Turkish in the December 2016 issue of Express Magazine, Turkey. It includes an in-depth analysis of the mobilization possibilities that the left has today, within the specific social configuration which has made Trump’s election possible.

Q: Ancient civilisations in Machu Picchu, Egypt, in Mesopotamia and elsewhere also suffered from social inequality, exploitation, and a fascination with construction to show off their wealth. The Mayas and the Egyptians also used the surplus value created in their societies for building ziggurats and pyramids. So what is different today?

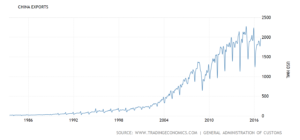

David Harvey: The difference I think with today is that capital systematically produces surpluses. It is producing surpluses of money capital, it is producing surpluses of commodities, so it doesn’t take political organisation to do it. The problem from a political stand point is how to absorb all of these surpluses which are being produced and the surpluses of labor and the surpluses of capital and surpluses of material and commodities and so on. Part of my argument is that increasingly over time, more and more of the absorption of that surplus product that comes with the capitalist form of organisation, it goes into city-building. I would suggest that probably about a quarter of the growth around the world right now is associated in some ways with urbanisation. I think in certain parts of the world such as China, the evidence we have is that for instance 25% of the growth just comes from building houses. And about 50% comes from building cities and building the infrastructures that connect and serve cities like highways, high-speed rail networks, water systems and the like. So about half of the Chinese economy I would estimate is actually dedicated to urbanisation.

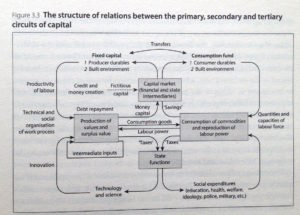

Q: So when you say a quarter of the economic growth, there is a difference between growth and accumulation. When we talk about a quarter of the economic growth being in the cities how are the three circuits of capital (the monetary circuit, commodities circuit, and the production circuit) related?

DH: Well, I think that production doesn’t produce value unless there is somebody to consume what is produced. So there is a relationship between the production of capital and the realisation of capital in the market. Now a lot of the realisation of the capital occurs through urbanisation. It is people buying houses, buying goods and the cultivation of a certain lifestyle. Think for example of how suburbanisation in the United States cultivates a certain lifestyle and then people in order to live in the suburbs need an automobile, they need highways, they need houses of a certain sort, they need shopping malls, they need refrigerators, they need lawnmowers, they need all kinds of things that go with the life style. So capital has been very much about the production of new needs by the production of new kinds of environments to which people have to adapt their consumption in order to survive. So there is a relationship then between the production and the marketing, or what Marx calls the realisation of capital. And there is a politics about realisation so that you find in the history of capitalism the production of new wants and needs, which has been a critical part of what capitalism has been about. And if you don’t produce new wants and needs, you have no new markets and if you have no new markets then production cannot continue to expand in the way that it has done. Now, the realisation of capital means the transformation of value from the commodity form into the money form. And then the money gets distributed. So who gets the money then also had a certain impact. Some of it goes to the banks who take the money and turn it back into production. You then get that overall circulation process where those 3 circuits that you have talked about are integrated with each other and each one of them plays a very crucial role in reallocating the flows of capital to urbanisation. For instance, free money is sitting in the banks and they have to make a decision of what to do with it. They look for people to lend to about certain projects. But increasingly we find that the banks are very much oriented towards mobilising the money to go into the production of urbanisation and the realisation of urbanisation. So you find banks financing the development at the same time as they actually finance mortgages that allow people to buy the development. So then the banks start to play a critical role in channeling a lot of the monetary wealth into the urbanisation process.

Q: What has been the effect of neoliberalism on this picture? What has changed since the 70s in this mechanism that accelerated this process?

DH: Neoliberalism is a really macroeconomic change in the philosophical basis that capitalism cultivates to insure its own reproduction. So what neoliberalism has been very much about has been creating an atmosphere of personal responsibility so that class solidarities that used to be sustained in societies through trade unions and the rest of it have essentially been destroyed in the past 30 to 40 years. But at the same time as this has been going on, more and more money has been pushed into the urbanisation process. And in particular we see all sorts of aspects of urbanisation which have changed. A much greater emphasis on urban spectacle, for example. And the advantage of urban spectacle is that it is quickly consumed. You have one Olympic games and then very soon you have another Olympic games. And this is all a very ephemeral consumption. If capital only made things that lasted a 100 years it would have died a long time ago. So increasingly it starts to focus its attention on the production of something that is ephemeral, doesn’t last very long, is instantly disposable so it even produces products that are instantly disposable and of course spectacle is an instantaneous production. Production is not instantaneous but the consumption is instantaneous. So increasingly urbanisation has become a vehicle for the cultivation of spectacle.

Q: The change that we saw in the 1970s, which a lot of people attribute to the oil crisis but you say was more than that, that there was a property crisis before that…what can we learn from the history of urban crisis and the changes in the 1970s?

DH: In my studies of urbanisation and the history of capitalism, what you see again and again is that a situation arises where the surpluses that are produced by capital have a very hard time finding a place for profitable activity. And so when a situation of that kind happens more and more of the surplus tends to flow into long-term projects in the built environment and urbanisation in particular. Now the advantage of this is that with long term projects you don’t know if they are viable until 5, 10 years later. So you absorb a lot of the surplus but you don’t know if it is profitable or if it is going to contribute to productivity until some time later. And then what often happens is that the move into these kinds of investments are always speculative. And the speculation takes off and very often it looks as if this is a very good thing to do so more and more money goes into it and all of a sudden there is over-production of the built environment. So that we get a property market crash or a ceasing of the expansion. For instance, in China recently, over the last 2-3 years, there is a huge urbanisation boom that has actually had a very very serious stopping and as a result of that the Chinese economy has been floundering quite a bit over the last 2-3 years with global influences because the surpluses can no longer be absorbed in the Chinese urbanisation projects, and therefore a lot of countries that are supplying raw materials to China to build houses or to build infrastructures, those countries have started to find themselves in economic difficulties. So what you see again and again is a wave-like movement of a flow into a place, and then it crashes, then it goes back into doing other things and it goes back up again. So we see these long waves if you like, sometimes there were even in the 19th century what they called building cycles, which were about 17-18 years long where you could see these long-term trends being worked out in this way.

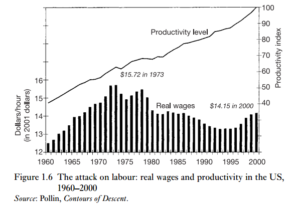

One of the features that became significant was the degree to which capital and the capitalist class was attacking the power of labor from the late 1960s onwards and managed in effect by the end of the 1970s to crush the power of the labor movement. To the degree that they did that, that meant that wages were coming down and the share of labor in the national income was beginning to diminish. Now if something like that happens, what that does is to start to constrict economic demand so the working people have less and less money to spend on goods and services. What that does is to create a problem of realisation of the value in the marketplace. So capital was faced with this dilemma of how to keep the market buoyant at the same time it was pushing the wage rate down. It solved the problem by telling everybody: get out your credit cards! So it came up with the ATM and the credit card culture. And the debt economy became very significant in actually resolving that contradiction. But in resolving that contradiction it created another contradiction which was increasing indebtedness. More and more of the population became heavily indebted, governments became much more heavily indebted so that by the time you get to 2008 that indebtedness has become so significant and so difficult to control that you get an explosion of crises which is partly around the fact that the debt had became unsustainable particularly in housing markets, particularly in urbanisation.

One of the features that became significant was the degree to which capital and the capitalist class was attacking the power of labor from the late 1960s onwards and managed in effect by the end of the 1970s to crush the power of the labor movement. To the degree that they did that, that meant that wages were coming down and the share of labor in the national income was beginning to diminish. Now if something like that happens, what that does is to start to constrict economic demand so the working people have less and less money to spend on goods and services. What that does is to create a problem of realisation of the value in the marketplace. So capital was faced with this dilemma of how to keep the market buoyant at the same time it was pushing the wage rate down. It solved the problem by telling everybody: get out your credit cards! So it came up with the ATM and the credit card culture. And the debt economy became very significant in actually resolving that contradiction. But in resolving that contradiction it created another contradiction which was increasing indebtedness. More and more of the population became heavily indebted, governments became much more heavily indebted so that by the time you get to 2008 that indebtedness has become so significant and so difficult to control that you get an explosion of crises which is partly around the fact that the debt had became unsustainable particularly in housing markets, particularly in urbanisation.

Q: Something else happened in the 1970s where before 1973 all money had to be backed by gold. That was changed in 1973. Was that the start of fictitious money?

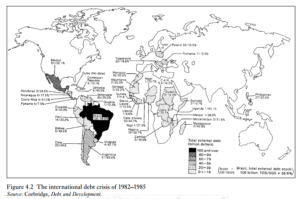

DH: Actually gold has not been a serious element in the global monetary system after 1939. It had a nominal role between 1939 and 1973 when the gold standard was entirely abandoned. But after 1973 it became clear that the main agents to stabilise the monetary system were going to be the global central banks. So you certainly see the Federal Reserve and the Bank of England and the Bundesbank in Germany becoming very critical, they took over the role of the gold standard. What they realised by the end of 1970s was that unless they exercised very strong discipline, there was going to be massive inflation. So there was a huge inflation surge of around 19-20% in the US at the end of the 1970s. That was followed immediately by a credit crunch in which the interest rate rose parallel with the inflation rate. Labor was left unemployed so you get the crises of the early 1980s. With that again a kind of question arises: where does all the surplus money go which is sloshing around the global economy? They then started lending it in developing countries. So developing countries like Brazil, Mexico and even Poland started to borrow very very heavily. And that again became a very important part of how the neoliberal economy began to work during the 1980s. It was a debt economy which was pushed very very strongly. Again it depends entirely on the policy and politics of the Central Banks as to exactly what is happening in the money supply system.

DH: Actually gold has not been a serious element in the global monetary system after 1939. It had a nominal role between 1939 and 1973 when the gold standard was entirely abandoned. But after 1973 it became clear that the main agents to stabilise the monetary system were going to be the global central banks. So you certainly see the Federal Reserve and the Bank of England and the Bundesbank in Germany becoming very critical, they took over the role of the gold standard. What they realised by the end of 1970s was that unless they exercised very strong discipline, there was going to be massive inflation. So there was a huge inflation surge of around 19-20% in the US at the end of the 1970s. That was followed immediately by a credit crunch in which the interest rate rose parallel with the inflation rate. Labor was left unemployed so you get the crises of the early 1980s. With that again a kind of question arises: where does all the surplus money go which is sloshing around the global economy? They then started lending it in developing countries. So developing countries like Brazil, Mexico and even Poland started to borrow very very heavily. And that again became a very important part of how the neoliberal economy began to work during the 1980s. It was a debt economy which was pushed very very strongly. Again it depends entirely on the policy and politics of the Central Banks as to exactly what is happening in the money supply system.

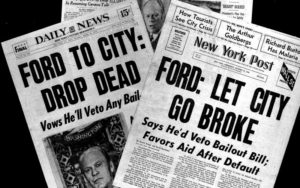

One of the significant things happened in the 1973-75 the property market crash, and then affected the bankruptcy of NYC which had the tenth largest public budget in the world at that time. And it wasn’t only NYC but a lot of other cities in the US went through similar kinds of financial distress. One of the significant things was the problem of the resolution of the budget crises. Before when something like this happened usually the investors took a hit. So it was not only NYC that would take a hit but also it was investors that would take a hit. The pain of the crisis was shared between the investors losing some of their money and the population losing some of their benefits.

But what happened in NYC was first of all that the government refused to bail them out. Secondly the philosophy that came out of that is that the investors should not lose anything at all. Now if investors can freely invest and not be responsible if the investment goes bad and they have no losses if the investment goes bad, then there is absolutely no risk attached to investment. So you had what was called “moral hazard” in the financial system that bad behaviour in the financial system was not punished because the state would always bail out those people who transgressed. So what we had was a very different financial system which was not going to be held to account. And we have seen that again and again and again. And even most recently in Latin America we had these hedge funds which are holding out and saying that Argentina has to pay off its full debt, and we are not going to allow any kind of cut in the value of the debt which we now hold. We are seeing many aspects of that playing out. Right now Puerto Rico is in the same boat, there is a big campaign not to bail out Puerto Ricco. Because the hedge funds then face a loss giving the terms to bail out. So they are not prepared to go along with this. So this is again one of the features of the neoliberal period that moral hazard entered the situation and the financiers will never lose their money on anything they invested in.

But what happened in NYC was first of all that the government refused to bail them out. Secondly the philosophy that came out of that is that the investors should not lose anything at all. Now if investors can freely invest and not be responsible if the investment goes bad and they have no losses if the investment goes bad, then there is absolutely no risk attached to investment. So you had what was called “moral hazard” in the financial system that bad behaviour in the financial system was not punished because the state would always bail out those people who transgressed. So what we had was a very different financial system which was not going to be held to account. And we have seen that again and again and again. And even most recently in Latin America we had these hedge funds which are holding out and saying that Argentina has to pay off its full debt, and we are not going to allow any kind of cut in the value of the debt which we now hold. We are seeing many aspects of that playing out. Right now Puerto Rico is in the same boat, there is a big campaign not to bail out Puerto Ricco. Because the hedge funds then face a loss giving the terms to bail out. So they are not prepared to go along with this. So this is again one of the features of the neoliberal period that moral hazard entered the situation and the financiers will never lose their money on anything they invested in.

Q: The start of neoliberalism in NYC and all the privatisation and anti-union movement of Wall Street at that time against the city of NYC… Was there a special relation of that to real estate?

DH: There was a special relation to that globally. Because what happened after 1982 shorty after this was the crash of NYC and the bail-out of NYC, which was eventually bailed out. The politics of the International Monetary Fund became effectively the politics that had been experimented with in the NYC bankruptcy, that is, the International Monetary Fund would find a country that was in debt, that would be in need of assistance from the IMF, than they would say effectively “well ok, you have to take all of the hit so investment banks in New York don’t have to suffer”. The first time this happened was in Mexico. So in 1982, when there was structural adjustment on Mexico, the population lost their living standards by about 25% in about 3 years to pay the debt. And the investment banks suffered very very little. So what this then did was to allow money to flow into property markets with a great deal of ease. So you had a flow during the 1980s of wild money going to property markets. And then a property market crash in 1988. And then in the 1990s in Sweden the property market went bad and you start to see bad property market things happening in South East Asia. After 2001 in the USA after the stock market crash there was a lot of surplus money and people were looking around for where they should put it. The Federal Reserve dropped the interest rate which made it very tempting to just go into urbanisation and build housing and all of that. So that’s why money flooded in a massive kind of way in to the property market from 2001 onwards and of course so much flowed in that you get as mentioned before the crisis of 2007 and 2008. So the history of this is an ongoing kind of history of surplus money flowing in to property markets being encouraged frequently by public policies and public supports and then it gets over extension and then you get a crisis. You know you get a property market crisis. What is interesting is that since 2007 and 2008 a lot of money is still flowing in to property markets. It has flowed in of course in China. Massively in China.

Composite House Sales Price Index (June 2007=100) in Turkey (Source: Reidin- Gayrimenkul Bilgi Servisi)

But there are other countries where this has happened, too. In Turkey, for example, there was a very significant flow into property development and TOKI buildings, all that kind of stuff. Urbanisation, big urban projects, building the new bridge over the Bosphorus, building a new airport. All of that kind of thing, was a typical kind of “ok where are we going to take the surplus”. And the result was Turkey showed a very high rate of economic development during these years, as did China. More recently of course–over extension, difficulties in the property market, and the Turkish economy starts to go down. China starts to go down. So these are the kind of things you start to see globally going on. But now the property market in major cities like London, New York, Shanghai and every capital city I know in Latin America, the property market has boomed like crazy. And if you look at what is going on in the Gulf States Dubai, Qatar and so on, so you look at the building going on there and a vast amount of surplus capital follow into crazy urban projects. If you look at the urbanization of Dubai, it is pretty ludicrous. This is the part of the world that is desperate for an economic development plan which is going to absorb a lot of people and their productive activities and all they can think of doing is building those monstrous kind of skyscrapers, with ski slopes inside the hotels, all sort of things like that. So this is what I mean when I say that we have reached the insane side of urbanisation where we are not actually building things, building cities for people to live in. We are building cities for people to invest in. And there is a big, big difference, it seems to me, in the structures of urbanisation now from the sort of structure that existed say back in the 1960s 1970s where much more attention was being paid to building cities for people to live in rather than just to invest in. Of course, the investors are the ultra rich and what we are seeing is a boom in the property market, the ultra rich can’t think of any other place to store their money, a lot of them are storing it in private property.

I want to add something to that. Here in NYC we have a crisis of affordable housing. We have a population, nearly half of the population is living less on than 30,000 dollars a year. But there is a huge building boom here and all of it is for upper-end condominium development for the ultra rich. The ultra rich are actually coming from all over the world to buy property in NYC. Developers are having a great time, you see massive development going all around the place, but if you try to deliver affordable housing to people who earn 30,000 dollars a year would mean, the maximum rent you should be paying is 800 or 1000 dollars a month. But the only people who can live with that are actually students who manage to find a bed sitting room for about 800 dollars a month. That is what you would get for 800 dollars a month. If you are a family of 4 and you are trying to live on 30,000 dollars a year, this is a tremendous crisis of affordable housing. There is almost no way in which the capitalist system can organise to deliver the kind of housing that the population needs. That is not only true for this country; it is true globally. In almost every major city I know, there is a crisis of affordable housing at the same time as there are mega projects, condominiums for the ultra rich and very often hardly anybody lives in them because basically they are a way of storing wealth for the ultra rich. And actually even the middle class in many parts of the world are doing this. I have seen this in Ramallah, I have seen this in Turkey too. So this is one of those things that have become a global problem right now.

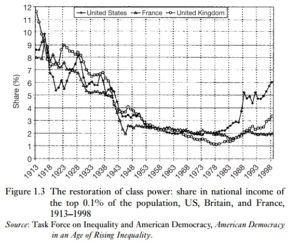

Q: A chart attracted my attention in your book “A Brief History of Neoliberalism”. It shows the share of income of the richest 0.1% of the population in the US and Europe. Right before World War I, they have about 12% of the total GDP. And through the two world wars it comes down to about 2.5%. From 1945 to the 70’s it pretty much stays stable and starting from the 70s onwards, it starts to go up again pretty fast. I don’t know about the current rate but I would not be surprised if it is back up to 12% already. How would you help us interpret this chart?

Q: A chart attracted my attention in your book “A Brief History of Neoliberalism”. It shows the share of income of the richest 0.1% of the population in the US and Europe. Right before World War I, they have about 12% of the total GDP. And through the two world wars it comes down to about 2.5%. From 1945 to the 70’s it pretty much stays stable and starting from the 70s onwards, it starts to go up again pretty fast. I don’t know about the current rate but I would not be surprised if it is back up to 12% already. How would you help us interpret this chart?

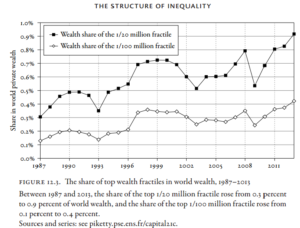

DH: First off, it would be the political assault that was mobilised during the 1970s against the power of labour. You have to start with that. Because it was only by dismantling the power of labour that you could gain power over the political institutions that would generate a Margaret Thatcher and a Ronald Reagan who would favour the upper classes so that when Ronald Reagan came to power the top tax rate was something like 80%, and he reduced it to 32% . So it is just reduction of taxes. And the history has always been that taxation should be progressive, that it should redistribute from the rich to the poor. But from the 1970s onwards we have tax policies implemented by governments, even socialist governments, which have increasingly becoming regressive, that is taking the wealth from the very poor and consolidating it within the upper classes. The theory of that is give the upper classes a lot of wealth than they will lead to development. But as I told you before they don’t do that. They just take the money and put it into these assets and speculate on asset values. They speculate on the stock market, speculate on land markets, commodities, on housing, and property and all those kinds of things. So it becomes a more and more speculative economy. This I think is one of those things that had a radical impact on how the upper classes are actually functioning. At the same time they are more and more consolidating wealth; we now see situations not only in this country but also elsewhere; where in effect an oligarchy controls the political process, controls the judiciary, controls the media and the result is there is almost no opposition to what it is they wish to do. And they are not famous for having a great deal of empathy with the conditions of life of the lower classes. That’s where the neoliberal ethics comes in and says if you are poor ti’s because you did not invest in your talents like I did. I am going to the best schools, buying the best education. I am being ironic here, they sort of don’t have any sympathy whatsoever for the impoverished population. What they have done is to organise a politics which redistributes wealth from the poor to the rich. Take for example the housing crisis, the loss of asset values amongst the impoverished populations in this country particularly Hispanic, African American populations, they have lost 2/3 of their assets in 1 year in 2007 – 2008. Where did all those assets values go? They got foreclosed, thrown out of their housing, big hedge funds come in and buy their housing for almost nothing. Now is renting it out. This is a huge transfer of wealth from one part of the population to the other. And this went on in a period of 2-3 years, still going on this day. This is how the economy is working. It is working even to produce even greater and greater wealth for that oligarchy. So when you look at the graph from the 1970s onwards it says wealth is going like this. The share of national income is going like this and it is going to continue to go like that unless there is a political process which stops it. It got stopped in 1939, 1930s in part by Roosevelt but not very strongly. It got stopped because of World War 2 and the power of labour after World War 2. So we had that interregnum which challenged the power of capitalist class up until the mid 1970s. After the 1970s onwards the capitalist class exerted almost total power, total hegemony and is even doing so in some of these countries that have joined into the capitalist systems. For instance Russia joins in, and very soon we find a few oligarchs controlling basically all of the economy. China joins in. As many billionaires in China now I think as there are in the US. And again all of this wealth distribution is now a global kind of question for instance there are huge number of billionaires emerging in India, China. Mexico has more billionaires than Saudi Arabia. So it is no longer a billionaire class that is located in the US and some parts of Europe. It is a global phenomena, and there is a global oligarchy which is in fact emerging right at this time.

Q: When I read your books, what really appeals to me is that you are not only making dry analysis but also looking for a solution to this situation. What kind of tools can we give to the people who are kind of caught up in this whole system to enable them to give a meaning to the structures, to the physical structures that they live inside of, like the city?

Q: When I read your books, what really appeals to me is that you are not only making dry analysis but also looking for a solution to this situation. What kind of tools can we give to the people who are kind of caught up in this whole system to enable them to give a meaning to the structures, to the physical structures that they live inside of, like the city?

DH: I am not one of those people who believes that ideas in themselves can change the world. But I do think that there is no way you can change the world without changing your ideas. So one of the functions that I would have in this situation would be to try to help people understand the nature of the society that produces a world of discontent, disappointment, and frustration. And for me try to create a framework of understanding in which people can locate what the nature of the problem is, is an important part of political struggle. What we see around us right now is a lot of misunderstanding. So if there is a frustration, it is the immigrants’ fault, or it is the fault of the poor, or it is the fault of anybody other than capital. And capital is very sophisticated at taking the tension away from itself and locating it somewhere else. To the degree that it controls media, it controls politics, it controls conversation, and is able to get away with it. So there is a big struggle to be waged on the part of those of us who are interested in transforming things against that situation. This would mean even a struggle inside of universities because universities are increasingly occupied by neoliberal, corporatist ways of thinking. And we need to have a critique of those ways of thinking and we need I think to provide that.

I am also of the opinion that capital will not destroy itself. There is a long strain of thinking according to which Marx thought that capital would fall as a result of its own internal contradictions. I don’t believe in that at all. I think that it has to be pushed, I think it needs strong social and political organisation to try to change direction, and to try to create a revolutionary movement that will radically transform daily life and root out the source and a lot of the discontent that now exists.

Q: So from the classical Marxist perspective you differ in the sense that you don’t just focus on the production side of surplus value creation but you also look at other aspects that are more entangled in urban life.

DH: I accept the proposition, which is foundational for Marx that, value is created in production and nowhere else. But there is a big difference between where the value is created and where it is realised. And what Marx argued at the end of just the first section of Capital was: If a capitalist produces a commodity that nobody wants, needs or desires, then it is not value. So actually the politics of making sure that people want, need and desire commodities is absolutely foundational for the whole kind of reproduction of the capitalist system. Which means that the history of capitalism has been very much about the creation, perpetual creation of new wants, needs and desires. And of course this has a very important role in defining what urban life is about. It is about organising wants, needs and desires. And organising it in such a way that people don’t have a choice. For example I may not want, need and desire an automobile, but if the only place I can live is a suburb I have to have an automobile. Not only do I have to have an automobile, but I’ve got to have a house of a certain kind. So the whole life style actually gets defined, which is consistent with what Marx would call a “rational consumption”. That is rational not necessarily from the stand point of people, but rational from the stand point of the accumulation of capital.

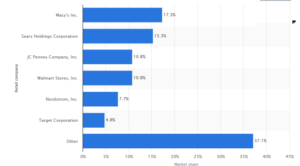

Now, this relationship between production and realisation is also I think very significant because the realisation of value is often in the hands of merchant capitalists. Merchant capitalists can take a bit of value which is produced by the producers and realise it for themselves in the market. So if you look at something like a computer, an Apple computer, it is made in Shenzhen. Foxconn, which makes the Apple computer, gets about a 3% rate of profit. Apple which sells the computer gets 27% rate of profit. What we see is a transfer of the value from the point of production to the point of realisation. And if you look at the structure of the global economy right now, you will see all of these companies like Walmart, IKEA… they are all merchant capitalist companies. The Waltons are the richest people in the world right now, and they don’t make anything. They are simply appropriating value at the point of sale. And they can put incredible pressure on the producers to lower the wage rates to create highly efficient and very low profit, production systems actually to create the commodity that can be sold at a major profit within the US. Marx talks about the way in which production and realisation have to be seen as a contradictory unity. And my argument is that a lot of people concentrate on production, as if realisation didn’t matter, or were secondary. But it is not. It is absolutely foundational.

And if you want to understand the dynamics of urban life right now, you’ve got to understand the politics of realisation and everything that goes on there because a vast amount of value is being extracted at the point of realisation often by people who are not doing anything in relation with production. For example, one of the most scandalous things we came across recently was that a hedge fund took over a pharmaceutical company that actually produces a drug for a certain kind of illness. That drug was selling at 12 dollars a pill. But the hedge fund came in, took over the company, and then said we are going to sell that pill for 750 dollars a pill. Ok. There is nothing illegal about that. But this is the appropriation of value through merchant activity by the hedge funds, by all those rich folks who come in without producing anything. And they actually can do that because there is only one drug of this kind, they own it and they can charge whatever they want. This is the sort of thing that we have to look at. If you ask people what their frustrations are, they will say things like, “Well I am very frustrated about my landlord and the amount of money I have to pay on rent. I am very frustrated and angry at the telephone company, for the all the extra charges on the telephones. I am very angry about the banks and the credit card companies that put extra charges on things.” So actually a lot of discontent is to be found at the point of realisation rather than at the point of production. And we have to acknowledge that if we are going to have a political movement which is anti-capitalist, then it has got to operate both at the point of production and at the point of realisation. And I have been arguing that for a considerable amount of time. It is very hard to get Marxists to accept it, because of the dogma that somehow or other the only point that matters is production and class relations in production. And I am saying no, social relations at the point of realisation are equally important.

Q: Hence building a movement that has urban roots fulfills this argument…

DH: Well, it also happens that this argument meets what the major struggles around the world have been about for the last years. What was Gezi Park? Was that an uprising of working class against the capitalist class? No, it was about the discontents of urban living. And the uprisings in Brazil in 2013, around the same time, where the deepest discontents were about the qualities of urban living. If you look at some of the major movements that have occurred over the last 15 – 20 years, they have been actually urban-based discontent movements. And the left has to have a way of theorising the nature of those discontents in order to be able to address it in a unified way. So that there is some sort of alliance between the point of production organisation and organisation that goes on around the realisation of value.

Q: The kind of anti-capitalist struggle that was built by the 60’s 70’s by the working class, as you said ,they focused more on the production. But the new generation of uprisings are focused on urban issues. So how to bring them together? For example in Gezi Park we had a very difficult time bringing the unions into the resistance. Vice versa, people in Gezi Park did not care much about the unions. So there is this disconnection.

DH: So the question of how to unify the struggles on the production side and on the realisation side has been there all along. I think that if you look at something like the Paris Commune, obviously this was as much an urban event as it was a working class event. I always like the fact the first two measures of the Paris Commune were first the moratorium on rents, which is kind of an urban question, and the suspension of night work in the bakeries which is a labour kind of question. And the Paris Commune, at least I think, had good way to think about how those two things go together. And I think it is not quite true to say that major struggles amongst the working class at the point of production did not incorporate something that was going on in the communities around it. I mean the most successful strikes say the 1930s in the United States were those in which there was community solidarity behind the striking workers. So if you look at the strikes in the automobile companies, it was the whole city in fact that supported the strike. When that happens, it is much more powerful than the strike by itself. So there have been moments when the unity of the two comes together. That still tends to be the case. But there have also been also times when elements within the working class particularly through the trade unions [have fallen short of that] … now this is something very difficult for the trade unions. Are the Trade Unions actually working towards something like the benefit of the whole working class or are they simply about the benefit of their members in a particular sector? In other words, the steel workers, metal workers or something of that kind. And when they think in terms of those sectoral things, they frequently do not support mass action in the community. Unless they are kind of pushed into it by political forces. And there are some unions who are deeply hostile to the radical reformulations some of us might be concerned with. For example, the construction unions. The construction unions love the big developmental projects that many of us are highly critical of. So when we turn up and protest against the building of some mega project, they turn up in praise of the capitalists and say: We really need this. So the unions are a bit of a problem sometimes in relationship to this. But then the same is true for many community organisations. We have community organisations that are very radical, we also have community organisations that are very exclusionary, just very bourgeois, just want to protect their privileges in a gated community. So it is not like all community organisations are good. Some of them are good some of them are bad. The same is true for union organisations. The trick is to try to find a way to bring together the two. I have been advocating unsuccessfully that the trade union movement should pay more attention to organising on a city basis. And that you organise the whole working class of a city rather than simply the working class in these different sectors. If you organise it on the city level then, you would have a different kind of politics emerging because at the city level the movement would have to take account of the working conditions of the whole of the working class instead of the condition of that narrow segment that they represent in the particular industry that the union is organising. So this to me is one of the problems that exist in the form of political organisation that the left has inherited. I think we need to do something to change it. So we can put those neighbourhood organisations, workplace organisations together and then it becomes a much more powerful configuration. And by the way, there are quite a few examples recently of particular struggles I can talk about, in places like Los Angles where the success of the struggle is dependent crucially upon, precisely that combination: labour interests and community interests.

Q: Autonomy building around local administrations is seen as something very revolutionary in some leftist circles. On the other hand, there is also the tendency of capital to benefit from competitive regions. What do you think about this duality?

DH: I think to a degree that uneven geographical development is always basic to the organisation of any society actually but it has been exacerbated by the dynamics of capital accumulation. What we are finding is a kind of politics emerging around an uneven geographical development. Exactly the same way that I said to you that community organising could be good or could be bad. So I think the whole way in which the left thinks about tactics of uneven geographical development can be good or can be bad. Just to give you an example, I find myself supporting the sort of autonomous movement in Scotland but I supported it because of the kind of politics they were proposing. That is they wanted to divorce themselves from the neoliberal politics of London and to set up an alternative welfare state structure. Getting autonomy was very crucial for that project. I don’t support Catalan autonomy, because Catalan autonomy is about separating itself from its obligations to the rest of Spain. A lot of it is rather conservative and in fact rather self-aggrandising and so I don’t support that. My view of it is, if it is autonomy in the name of the right kind of thing, I support it. If it is autonomy is in the name of the wrong kind of thing, then I don’t.

I feel the same for instance about local organisation. In the US and everywhere else in the world now, a lot of gated communities that organise themselves, and say “we have a commons”, and they appropriate all the leftist language to exclude everybody else. So I don’t support that. On the other hand, I think there are ways in which you can create heterotypic spaces inside of the city, which can become actually centres for political organising that can then spread out. In other words, the left that has a geopolitical strategy or will use territory as part and parcel of its organising and has to think about how it does it. This is the way in which I would think about that.

Now in the Kurdish case in Southeastern Anatolia, I support that. I think that it has very important implications. I think the mode of governance that they are experimenting with is something worth following up. The assembly structure, I don’t know how well it is working, if it is working at all given the repressions of the Turkish government. I know it is something like what has been set up in Rojava and I find this very interesting. The same way that I find what the Zapatistas did in Mexico are very interesting. But again you don’t say ok, that’s the end of the story. Part of the problem with the left right now is the kind of the tendency to say: Once we have our own corner of the world and we organised it the way we want, we will disconnect from the rest of the world. And you cannot do that. As a part of a struggle, however the geopolitical struggle has to be thought out very well. And does it offer a pathway to an anti-capitalist future?

Q: In your Rebel Cities book, you say that the right to the city should not be looked at as a right to the city as is. It should be looked at that as a right to reconstruct the city in a way that does not serve capital. Can you elaborate on that? You write that “it is a right to rebuild, and to recreate the city as a socialist body-politic in a completely different image. One that eradicates poverty and social inequality, one that heals the wounds of disastrous environmental degradation”.

DH: I am very committed to that particular perspective. If you walk around NYC right now, you can kind of say “alright, how would we appropriate everything in NYC and turn it into a socialist paradise?” Well, it is going to be a difficult thing to do because the city is constructed in a certain way not to function well as the site of a socialist paradise. It is created in a way that acknowledges private property rights and the whole kind of structural organisations. The ultra rich buildings versus the social housing. So I think we need to change it because in the same way that capitalism has constructed the kind of the city which is appropriate for the reproduction of the capitalist social order, so it seems to me that a socialist project should be about reconstructing the city in ways which are consistent with socialist social relations, socialist distributions of income, socialist sense of what are adequate needs… wants, needs and desires that deserve to be catered to and fulfilled. So for me it is making the city again. And right now I think we have made cities which are increasingly difficult to actually command and turn into something which is politically able to function. I mean these kinds of assembly forms of governance are very difficult put into a city like NYC. Communities used to have community boards. We still have them in a very disempowered form, but they were very powerful in the1950s and 1960s. So we have to do something to change the political organisation of the city, we have to change the built environment in the city, we have to create, for example, new public spaces. Public space in NYC is very hard to come by. Maybe we happen to be at one such space here and I think there are some very good public spaces around. But by and large this kind of place which you can call commons of the city is being effectively eroded. We need to recapture and occupy parts of the city that have been appropriated capital or by the capitalist state so that people cannot use them in an open and political way. The question for me is a dual question. The first is what kind of city do we want to have? But that to me has to be subsumed under the question what kind of people do we want to be? Because the kind of the city we build has a lot to say about what kind of people we can be. Suburbs build a certain kind of persona. And I think that we need to change the suburbs and turn them into something radically different so when the persona changes and people exercises social responsibility instead of perfectly isolated individualism of the sort we now have.

I think it depends very much on where you are. I mean the Chinese government faced in 2008 – 2009 an immense collapse of the export industries because of the collapse of the consumer market in the US. They had a vast number of people unemployed. And at that point the communist party notoriously nervous about political agitation amongst the working population. So basically they made a political decision that they were gonna urbanise like crazy. It was a political decision. They turned to the banks and said to the banks “lend”. They then turned to all of the municipalities and regions and said “create as much as you can, build cities and absorb as much labour as you possibly can”. And all of that unemployment that existed in 2009 was absorbed by the end of the year in this vast urbanisation project. So this was a political decision to rescue capitalism from itself. The urbanisation decision in China basically rescued global capitalism because it was the only growth centre during these years. That was a political decision. Here in NY, however, it is also a political decision but politics is very much subservient to the power of the investor. And investors basically dominate politics and they do it in a certain kind of way. For example the famous bail-out of the banks in this country. They gave the banks a lot of money and basically said to the bankers “I hope you lend”. And the bankers said we are not going to lend, we don’t feel like it. And they basically told Obama to get lost.

Now, if you are a Chinese banker you don’t tell the communist party and central committee to get lost. Because it is not worth it. Basically you have a different political organisation in which in China it is still the case that the Central Committee of the communist party is still very much in control of the macro levers of the economy. In this country, it is the investors. There is a famous statement from Bill Clinton just after he had got elected, setting up his economic team and he was getting very strong advise as to what he should do. And he basically said: do you mean to say that I have to actually cut my economic policy to the demands of a bunch of fucking bond traders? And the answer from all of his advisers was: Yes, thats what you have to do. So government has effectively in this country been very much dominated by the bond holders. Now we have seen some very interesting struggles over this. For instance, who controls the politics being inflicted on Greece? Is it a political thing or is it the bond-holders who are actually calling the shots? Right now globally I would say bond holders in many instances are the big carriers of the economy. But in certain parts of the world China or maybe even Turkey and some other country–Singapore, South Korea–you see increasingly I think the state in politics is ahead of the game.

Q: Who are the bond-holders?

DH: The bond holders are the major investors in stocks and shares and bonds in the stock market. And of course there are leading figures, something like Warren Buffet in this country. He was once asked “is there class struggle?” He said “of course there is class struggle, and my class is winning”. And there is a group of obviously very prominent people, who are extremely dominant in the way the global economy is working, I mean the people who run Apple, the people who run Amazon. This is the new kind of bourgeois power structure which has emerged over the last 15-20 years which is very much in control.

Q: You say that the capital is in an incline and is at a turning point. You also say that these cyclical crises of capital are great opportunities for anti-captalist struggles. What can you say about the next crisis and where we must look to advance that struggle?

DH: I have no idea where the next crisis is coming from. One of the things that is true for capital these days is, it is very volatile, things happen very quickly. You never know where the next crisis is coming from. But I am willing to bet very strongly that whatever the crisis is and in a sense we are already rumbling around in it, there is always going to be an urban property component in it. How? Whether it is a major component or a minor component who knows? Could be more of a geo-political crisis. May even involve military confrontations in the world economy. Those things can shift very quickly. But I think the left has to have some very coherent policy right now. A very coherent thinking. This is a very difficult thing to organise. I think, however, that what we are seeing in politics, is a willingness now to consider options and possibilities that were not there before. It would be unthinkable 5-6 years ago to have a major person actually drawing in great crowds and saying we need a political revolution in this country. At the same time we of course have got other people on the right, so we have a right-wing version of this, we have a neo-fascist movement in much of Europe. We have increasing authoritarianism in many parts of the world: Turkey and Brazil, Austria and Hungary, and all the rest of it. A lot of difficulties right now. But politics as usual I think is dead right now and I think there is a big fight to redefine what the political project is being about. I am very much trying to argue that it has to be anti-capitalist and it has to have an anti-capitalist strategy. I am in a very small minority, but it does not stop me arguing. But I think that more and more people are seeing that capital is nor delivering the goods in the way that it should. That the kinds of jobs that are available even when they are available, shit jobs, the kinds of living circumstances in cities are becoming less and less tolerable. More and more traffic jams. More and more difficulty getting around, more and more pollution. There is a lot of discontent. So I think that those have to be consolidated. I think that to the degree that people start to ask questions about why this discontent in the midst of all this technical capacity to do things. And in midst of all of these existing possibilities why is it that we are not actually organising things in a way that makes for a decent life and a decent living environment for the mass of the population? That simple question I think can lead people politically to actually doing something radically different.

Q: How do you see the prospects of newly emerging islands of solidarity economies? Can they provide the answer to a non-capitalist future?

DH: A lot of things that go on in this country are not organised within capitalism. There is a whole–there is a very large–let’s call it non-capitalist sector. I think that non-capitalist sector can be expanded and developed. The kinds of social relations which many people are seeking can be evolved through experimental configurations. I tend to say right now hey look we should experiment. We should try all sorts of things. I don’t think anybody knows exactly what will work. You won’t find me saying “eh, solidarity economy, no that won’t work, they are no use”. I tend to say, “Look, I think it is good that we organise such forms,” even if I am very skeptical that they are going to lead us to an anti-capitalist future. But go ahead and lets see what we can make of it. On the other hand, I really do think that we do need some political organisation–whether you call it a party or not that is another question. And we do need to recognise that there are a lot of power within the state apparatus that need to be mobilised and orchestrated so that some of these experimental things that are occurring on the left can become more generalised.

Q: What can you say about the rise of Bernie Sanders?

DH: Was he purely running a campaign or was he using a political campaign to mobilise a social movement? Because we have seen before Jesse Jackson, Ralf Nader and people like that. They mobilise for the presidential thing and then it is all over then they disappear. And the movement disappears. It would be a very interesting thing to see. Clearly Sanders was not going to be the president. But maybe he can reshape the Democratic Party into a political party with a real political agenda and actually construct a social movement that actually takes over the Democratic Party in the way that the capitalist class took over the Republican party in the late 1970s and began to use it as an instrument of its own politics.

Q: And then people call you a reformist…

DH: Yeah, of course, and then people call me a reformist when I say that. [laughing] In my view, the revolutionary perspective is zero right now. And as a good friend of mine once said to me, the difference between a revolutionary and a reformer is that we can do exactly the same things and actually can collaborate 100% at a particular historical moment, while doing them with different motives in mind.

Q: Contrary to general opinion, you say that Trump had a very high chance of winning, and you were proven right. [the interview was taken in the summer of 2016]

DH: In Seventeen Contradictions, I had written about the increase in what I called a state of Universal Alienation and the dangers that derived from that political state. So the times were in any case dangerous. Trump could present himself as someone who had made a lot of money in business and who was prepared to spend it on behalf of all those alienated and discontented people who had not benefited from the way the system was working and who resented the power of elites who milked it for themselves. Clinton could be depicted as someone who had gone into politics and become part of the elite system in order to make money for herself and by giving speeches in recent years to Goldman Sachs for $270,000 a time could not be trusted to do things for the good of the people. Faced with two people of that sort who would the common but alienated worker in a bar in Muncie, Indiana choose?

Q: How realistic are the assumed economic policy positions he has presented so far?

DH: Nobody knows what Trump will actually do. He needs to create jobs and may do it through a Keynesian-style infrastructure investment program in which case he will have to deficit-finance, which will not make the Republicans happy and he may need Democratic support to do it. If it is big enough, it may create jobs. On the other hand, he may make a program that is a scam for investors in infrastructure to make easy money at the state’s expense. He cannot bring back jobs through protection and reversion to fossil fuels. Immigration will be a big issue but again what he said and what he might do are two different things.

Q: How will the future of anticapitalist struggle be shaped in the US and globally under a Trump presidency?

DH: This is an opportunity for an anti-capitalist project to take hold but my fear is that it will not do that if everything is about Trump. He likes the attention and is brilliant at turning discontent with him to his own political advantage. The left should ignore him and organize towards an alternative to capital, not to Trump.